Roof surfaces extended coverage allstate – Allstate’s Roof Surfaces Extended Coverage takes center stage, offering homeowners peace of mind against the elements. This coverage provides comprehensive protection for your roof, ensuring that your home remains safe and secure.

Delving into the intricacies of this coverage, we will explore its scope, exclusions, cost considerations, and the claims process. By understanding these aspects, homeowners can maximize their coverage and safeguard their most valuable asset.

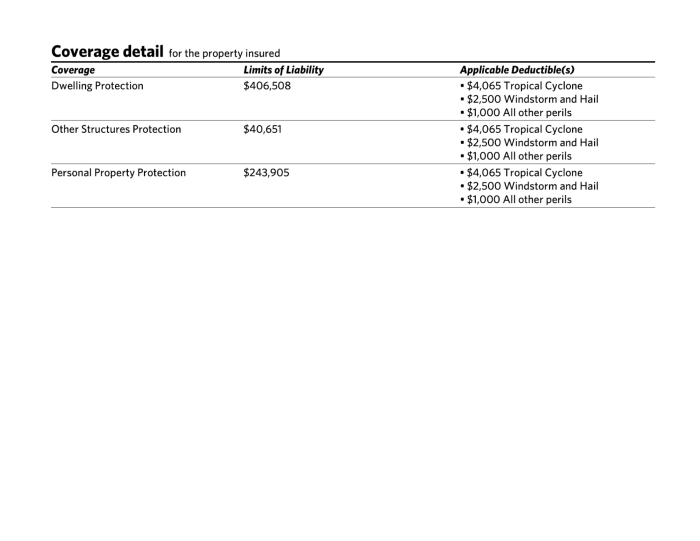

Coverage Details

Allstate’s roof surfaces extended coverage provides additional protection beyond the standard homeowners insurance policy. It covers specific perils that can damage or destroy roof surfaces, such as:

- Hail

- Wind

- Lightning

- Falling objects

- Weight of ice or snow

Endorsement vs. Policy Inclusion

Roof surfaces extended coverage is typically offered as an endorsement to the standard Allstate homeowners policy. This means that it is not automatically included in the policy and must be specifically requested by the policyholder. The endorsement can be added to the policy at any time, but it is typically recommended to do so before a storm or other potential hazard occurs.

Policy Exclusions

Roof surfaces extended coverage does not cover all types of damage to a roof. Exclusions may include:

- Damage caused by neglect or lack of maintenance

- Damage caused by insects or rodents

- Damage caused by wear and tear

- Damage caused by improper installation or repairs

Cost Considerations

The cost of roof surfaces extended coverage will vary depending on several factors, including:

- The type of roof

- The age of the roof

- The location of the property

- The deductible

Generally, roofs that are older or located in areas with high winds or hail will have higher premiums.

Claim Process, Roof surfaces extended coverage allstate

To file a claim under roof surfaces extended coverage, the policyholder must contact Allstate and provide the following information:

- The policy number

- The date of the damage

- A description of the damage

- Photographs of the damage

- An estimate for the cost of repairs

Allstate will then investigate the claim and determine whether it is covered under the policy.

Comparison with Other Insurers

Allstate’s roof surfaces extended coverage is comparable to similar offerings from other major insurance providers. However, there are some key differences in coverage, exclusions, and pricing.

For example, some insurers may offer coverage for additional perils, such as earthquakes or volcanic eruptions. Others may have lower deductibles or higher coverage limits.

It is important to compare the different options available and choose the policy that best meets the needs of the policyholder.

Tips for Policyholders

Policyholders can take several steps to maximize their coverage under roof surfaces extended coverage:

- Inspect the roof regularly and make repairs as needed.

- Keep the roof clean and free of debris.

- Trim trees and shrubs around the home.

- Install wind-resistant shingles or other protective measures.

By taking these steps, policyholders can help prevent damage to their roof and ensure that they are fully covered in the event of a claim.

Question & Answer Hub: Roof Surfaces Extended Coverage Allstate

What types of roof surfaces are covered under this policy?

Allstate’s Roof Surfaces Extended Coverage typically covers various roof types, including asphalt shingles, metal, tile, and wood.

What perils are insured against under this coverage?

This coverage typically provides protection against perils such as wind, hail, snow, ice, and falling objects.

Is roof surfaces extended coverage typically offered as an endorsement or a standard inclusion in Allstate homeowners policies?

Roof surfaces extended coverage may be offered as either an endorsement or a standard inclusion, depending on the specific policy and state regulations.